December 10, 2021

Why CARB Helps Big Companies Win Against the Startup’s CAC

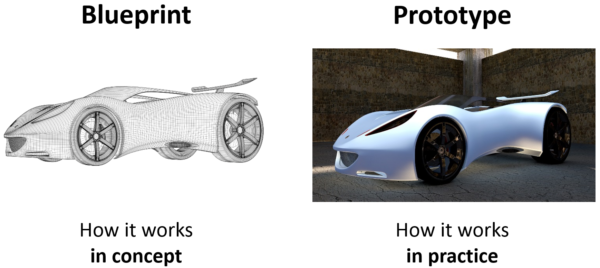

Fast-Forward® Market Landscape Prototype

7 minute read

Today’s Entrepreneurs have moved beyond using CPM impressions to judge their media plans and into tying each element of their marketing spending directly to the acquisition of a customer. With this, we’ve seen an explosion of new acronyms (e.g., CPC: Cost Per Click, CTR: Click Through Rate, CPA: Cost Per Aware, etc.), but CAC (Cost to Acquire a Customer) has been the one with the most impact in the tech startup world (further context here).

In contrast, while Big Company Intrapreneurs are using CPC and CTR, many have been slower to fully embrace CAC as a key measure in commercialization planning, primarily for two reasons. First, many Big Companies simply don’t collect and organize their data in a way that enables the Intrapreneurs in the company to calculate their CAC. Second, everyone knows that a good Big Company Intrapreneur can efficiently “buy” trial, thereby limiting the effectiveness of measuring CAC (e.g. sampling everyone can drive trial and deliver a low CAC, but it’s not helpful if those triers are not in the target and therefore are unlikely to deliver the repeat buyers critical to a sustainable business).

Given the success Entrepreneur’s are experiencing imbedding CAC measurement into their culture while also recognizing that Intrapreneurs can skew the numbers with “trial buying” programs, we think it’s time to push deeper and evolve the discussion to the Cost to Acquire a Repeat Buyer (CARB), a more comprehensive tool that transforms the Entrepreneur tool into one that also works for Intrapreneurs.

Calculating The “Cost to Acquire a Repeat Buyer” (CARB)

The simple way to calculate your CARB is to divide your new buyer spending by the number of new repeat buyers you get. That calculation is a helpful dashboard measure and can give you a yeah/nay verdict on your plan’s effectiveness, but to get to actionable data, you’ll need to understand more elements of the calculation to identify specifically where to focus your efforts to fix a problem or exploit an opportunity.

Our simple, starting point calculation is as follows:

Cost Per Aware (CPA)

The first part of this formula are the components of Cost Per Aware (CPA):

- CPM: The CPM (i.e. Cost per Thousand Impressions) is readily available from agencies, but these aren’t your only sources. For a fairly conservative estimate, you can use the costs in Google AdWords as a starting point to see if it’s a key value driver. From our experience, CPMs are RARELY a key value driver, so no need to spend much time on this in the early stages of commercialization prototyping.

- Media Effectiveness Factor: This is a factor to adjust potential elements that would explain why each impression isn’t guaranteed to create awareness. While there are a number of potential factors, the two biggest are: 1) the “environment” around the impression have different abilities to grab a potential buyer’s attention (e.g. a banner ad impression is NOT equal to an impression given in-store) and 2) different creative executions will differ in their ability to grab a potential buyer’s attention.

With these two, you can now calculate your CPA (Cost per Aware). If you are working an innovation and don’t have benchmarks for these, research your company’s historical in-market results on launches. Or, if your company doesn’t track awareness, look at the pre-market research to see the estimates they were using. Also, feel free to contact us to learn how we are doing this for other companies using this historical research database.

Cost to Acquire a Customer (CAC)

From CPA, the next step is to incorporate the Purchase Intent component:

- Purchase Intent: This component adjusts for the fact that not everyone who becomes aware will be compelled to try. Here too, there are many potential factors, but the two biggest are: 1) some people simply won’t be interested, and 2) the communication may not effectively convince everyone who would potentially be interested to buy (i.e., concept research doesn’t measure yes/no, it measures interest on a scale).

With this added, you can calculate CAC (Cost to Acquire a Customer). The core benefit of calculating CAC is it helps you understand the “investment” you’ll need to make to acquire customers and enables management (or an investor) to separate the investment needed to build the product and organizational infrastructure from the costs to bring buyers into the franchise. However, we all know that good marketers with big enough budgets can “buy” trial, which can significantly cloud the understanding of the true sustainability of the business which comes from driving trial among new buyers that become repeat buyers and generate recurring revenue year after year. And, that’s why we bring in the Repeat Rate factor.

Cost to Acquire a Repeat Buyer (CARB)

The final step is to incorporate the Repeat Rate:

- Repeat Rate: This metric is simply the percent of New Buyers who purchase 2 or more times. The objective of bringing in this measure is to ensure that the costs that were “wasted” on making people aware who did not buy and “wasted” on getting people to buy but not become repeaters, get properly allocated to the cost of acquiring a repeat buyer. We’ve also seen this referred to as the Concept/Product Fit Factor, but we like repeat rate better as that’s what ultimately drives the long-term sustainability of a business (e.g. we’ve seen products succeed despite poor concept/product fit… think tree air-fresheners hanging from rear-view mirrors).

With CARB, the Entrepreneur’s obsession with attaching every launch marketing dollar to an acquired customer can be transformed into a tool that works within the Big Company process, enabling Intrapreneur’s to move beyond CPM and CAC and deliver a detailed understanding of the costs to acquire repeat buyers (CARB), the core engine of their business. Even better, data from both past launches and from past and current market research can be used to create a solid set of benchmarks, giving Intrapreneurs deeper pre-market insight into where to focus their spending, well before an Entrepreneur learns from their costly in-market mistakes and subsequent pivots.

Building Your Company’s Database

Now that you have a deeper understand of CARB and it’s sub-components (CPA and CAC), an easy first step would be to build a benchmark database in your company by looking at historical launches as well as back calculating from your company’s market research. If helpful to get our perspective, or compare your benchmarks to industry benchmarks, feel free to give us a call while you do this.

Key Points

- Entrepreneurs are creating an advantage by understanding the effectiveness of each marketing activity at generating new buyers, enabling them to quickly focus scarce marketing dollars on the activities creating the most value.

- Big companies have the data for Intrapreneurs to win back the advantage by using their historical spending and market research to focus their launch marketing spend on the few key activities that drive the most repeat buyers (i.e., the buyers who become the profit engine of a business) for their company.

CARB & Fast-Forward®

CARB is a key component of our Fast-Forward® approach. Fast-Forward® is our proprietary methodology that brings together the strengths of the Big Company and Startup approaches to enable a team to rapidly design and optimize multiple plans to determine the best plan to turn an innovation into a successful business, pre-market. To learn more about how Fast-Forward® works and how it will help you turn your great idea, technology, product or service into a valuable new business, contact us with your availability and we’ll find a time to connect to explore how we can bring our proven success to your team.